Crown ‘completely failed’ to take seriously multiple red flags about potential money laundering at its casinos, an inquiry has heard. Rebecca Le May and Gerard Cockburn NCA NewsWire November 9. Lots is often written about red flags within a sector to spot money laundering but not much is written about cross-sectoral red flags that can help investigators identify potential money laundering, where the combination of factors in different sectors may increase the probability of the incidence of money laundering. Crown Resorts chairwoman Helen Coonan has admitted the casino giant missed red flags of possible money laundering involving VIP high rollers. Ms Coonan, a former federal Liberal senator, faced a. For additional guidance, see Casino or Card Club Risk-Based Compliance Indicators, FIN-2010-G002 (June 30, 2010) and Frequently Asked Questions – Casino Recordkeeping, Reporting and Compliance Program Requirements, FIN-2007-G005 (November 14, 2007) and FIN-2009-G004 (September 30, 2009), and Recognizing Suspicious Activity - Red Flags for Casinos and Card Clubs, FIN-2008-G007 (August 1, 2008). Ms Coonan said she was confident Crown was “ready and suitable” to open its new $2.2 billion casino at Barangaroo in December, with improvements underway at the group including the recruitment of a new “head of compliance and financial crimes” to oversee its under-resourced anti-money laundering team.

December 1, 2020

The casino industry is a target for criminals looking to launder their profits gained through illicit activities such as drug trafficking and human trafficking.

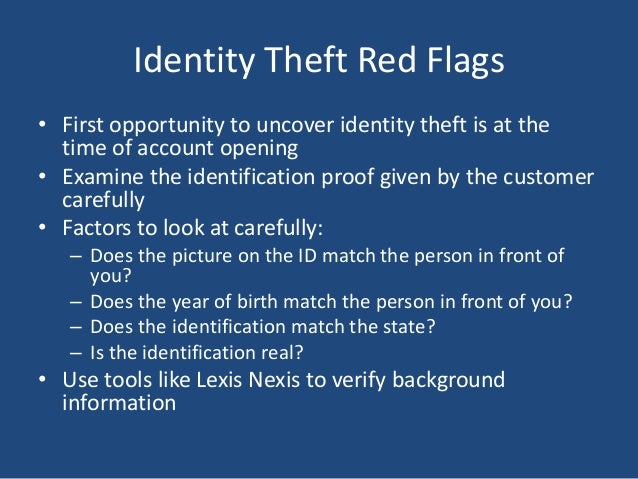

Money laundering in casinos can happen in many forms. In some cases dirty money is converted into chips, played with for a short while, then cashed out in the form of a check. Another way that money laundered in a casino is through the use of individuals using false identification to create multiple accounts to avoid tracing money laundering transactions taking place in the casino.

In many jurisdictions, casinos are required to register with their financial intelligence unit and implement an effective anti-money laundering (AML) program. Failure to do so can result in hefty penalties.

In the UK, from January to May 2020, the gaming industry paid £27m in settlements over regulatory action. Toward the end of 2019, the UK crackdown on online casinos netted another £8.7m. Two of the offences occurred just a month after other four other companies were fined more than £4.5m for similar money laundering infractions. That brings the total fines in 2019 to more than £13.2m.

In the U.S., casinos must comply with Bank Secrecy Act (BSA). FinCEN, the financial intelligence unit for the United States, issued guidance in 2010 regarding AML/BSA compliance programs, stating that, “at a minimum,” such a program must include:

- A system of internal controls to assure ongoing compliance with the BSA;

- Internal or external independent testing for compliance with a scope and frequency commensurate with the risks of money laundering and terrorist financing posed by the products and services provided;

- Training of casino personnel, including training in the identification of unusual or suspicious transactions;

- An individual or individuals to assure day-to-day compliance with the BSA;

- Procedures for using all available information to determine and verify, when required, the name, address, social security or taxpayer identification number, and other identifying information for a person;

- Procedures for using all available information to determine the occurrence of any transactions or patterns of transactions required to be reported as suspicious;

- Procedures for using all available information to determine whether a record required under the BSA must be made and retained; and

- For casinos and card clubs with automated data processing systems, use of the programs to aid in assuring compliance.

Money Laundering Reporting

Casino Money Laundering Methods

In terms of suspicious activity being reported to FinCEN in 2019, “Minimal Gaming with Large Transactions” was the highest reported activity with more than 5,000 Suspicious Activity Reports (“SAR”). Other frequently cited suspicious activities include:

- Transactions below CTR Threshold

- Unknown Source of Chips

- Two or More Individuals Working Together

- Alteration or Cancelation of Transactions to Avoid CTR Requirement

- Suspicion Concerns on the Source of Funds

Suspicious activity involving sports betting, abandoned jackpot, and bill stuffing were often cited in SAR forms for those who checked the “other” box.

Warning from FinCEN

At a recent conference, FinCEN Director Kenneth Blanco warned casinos that cuts to compliance budget in order to reduce costs and retain gamblers is seen by the agency as a national security issue and the agency would not take the issue lightly.

“So it concerns me when I hear about some compliance budgets being cut by casinos looking to trim costs and retain gamblers. To be clear—we take the culture of compliance seriously. This is a national security issue: not something to be taken lightly—and we will not take it lightly.”

“FinCEN is continually looking at compliance across all financial institutions and will not hesitate to act when it identifies financial institutions that violate the BSA. It is also important to note that not all enforcement actions are public—FinCEN often closes cases with warning letters sent to financial institutions or refers cases to our delegated examiners to conduct additional examinations.”

The regulator also expects casinos to integrate the latest products into into their existing AML programs. “Sports betting, and other mobile gaming services run through your casino, are no different than other products and services. FinCEN expects that your casino or card club is monitoring your sports betting programs for potentially suspicious activity. This includes offering sports betting through a mobile app.”

Red Flag Indicators for Casinos

FinCEN is not the only regulator putting pressure on casinos to detect money laundering in their organizations. In the UK, a casino company has been fined a record £13m (USD$16 million) by the Gambling Commission for failing to prevent money laundering and for allowing people with gambling problems to lose huge amounts over repeated visits to its casinos.

Casino Money Laundering Red Flags Pictures

For these reasons, it is imperative that casinos implement an effective AML compliance program.

FINTRAC, Canada’s Financial Intelligence Unit, offers a list of money laundering (ML) and terrorist financing (TF) indicators to help all casinos detect potential money laundering and comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and associated Regulations. While issued by the Canadian regulator, these indicators are useful for any casino operating in any jurisdiction. Here is a subset of some of those indicators.

Money laundering indicators related to identifying the person

- When opening an account, the client refuses or tries to avoid providing information required, or provides information that is misleading, vague, or difficult to verify.

- Identification presented by the client cannot be verified.

- Inconsistencies in the identification documents or different identifiers provided by the client.

- Client produces seemingly false information or identification that appears to be counterfeited, altered or inaccurate.

- Client displays a pattern of name variations from one transaction to another or uses aliases.

- Client alters the transaction after being asked for identity documents.

- The client provides only a non-civic address such as a post office box or disguises a post office box as a civic address for the purpose of concealing their physical address.

- Transactions involve individual(s) identified as being linked to criminal activities.

Money laundering indicators related to client behavior

- Client conducts transactions at different physical locations, or approaches different staff.

- Client exhibits nervous behavior or has a defensive stance to questioning.

- Client presents confusing details about the transaction or knows few details about its purpose.

- Client avoids contact with reporting entity employees or refuses to provide information.

- The client refuses to identify a source for funds or provides information that is false, misleading, or substantially incorrect.

- Client makes inquiries/statements indicating a desire to avoid reporting or tries to persuade the reporting entity not to file/maintain required reports.

- Client closes account after an initial deposit is made without a reasonable explanation.

Money laundering indicators surrounding the financial transactions in relation to the person profile

- The transactional activity is inconsistent with the client’s apparent financial standing, their usual pattern of activities or occupational information.

- Client appears to be living beyond their means.

- Large and/or rapid movement of funds not commensurate with the client’s financial profile.

- Opening accounts when the client’s address or employment address are outside the local service area without a reasonable explanation.

Money laundering indicators related to products and services

- A product and/or service opened on behalf of a person that is inconsistent based on what you know about that client.

- Use of multiple foreign bank accounts for no apparent reason.

- Credit card transactions and payments are exceptionally high for what is expected of the client including an excessive amount of cash advance usage, balance transfer requests or transactions involving luxury items.

Money laundering indicators related to transactions structured below the reporting or identification requirements

- Client appears to be structuring amounts to avoid identification or reporting thresholds.

- Client appears to be collaborating with others to avoid identification or reporting thresholds.

- Multiple transactions conducted below the reporting threshold within a short time period.

- Client makes inquiries that would indicate a desire to avoid reporting or exhibits knowledge of reporting thresholds.

Visit the FINTRAC site to see the full list of indicators.

Guidance from FATF Groups

The Asia/Pacific Group on Money Laundering (APG) also provides information on Vulnerabilities of Casinos and Gaming Sector. Their list of indicators of money laundering using casino accounts includes:

- Frequent deposits of cash, cheques, wire transfers into casino account.

- Funds withdrawn from account shortly after being deposited.

- Account activity with little or no gambling activity.

- Casino account transactions conducted by persons other than account holder.

- Large amounts of cash deposited from unexplained sources.

- Associations with multiple accounts under multiple names.

- Transfer of funds from/to a foreign casino/bank account.

- Transfer of funds into third party accounts.

- Funds transferred from casino account to a charity fund.

- Multiple individuals transferring funds to a single beneficiary.

- Structuring of deposits / withdrawals or wire transfers.

- Using third parties to undertake wire transfers and structuring of deposits.

- Use of an intermediary to make large cash deposits.

- Use of gatekeepers, e.g. accountants and lawyers to undertake transactions.

- Use of multiple names to conduct similar activity.

- Use of casino account as a savings account.

- Activity or income is inconsistent with the customer’s profile.

- Use of false and stolen identities to open and operate casino accounts.

- Customer name and name of account do not match.

- Requests for casino accounts from Politically Exposed Persons (PEPs).

They also provide money laundering indicators using

- winnings

- currency exchange

- credit/debit cards

- false documents and counterfeit currency

- casino value instruments

- structuring/refining methods

For this reason, it is worth referring to the document to learn more about how to mitigate your patron and transaction risks.

For these reasons, it is imperative that casinos implement an effective AML compliance program.

FINTRAC, Canada’s Financial Intelligence Unit, offers a list of money laundering (ML) and terrorist financing (TF) indicators to help all casinos detect potential money laundering and comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and associated Regulations. While issued by the Canadian regulator, these indicators are useful for any casino operating in any jurisdiction. Here is a subset of some of those indicators.

Money laundering indicators related to identifying the person

- When opening an account, the client refuses or tries to avoid providing information required, or provides information that is misleading, vague, or difficult to verify.

- Identification presented by the client cannot be verified.

- Inconsistencies in the identification documents or different identifiers provided by the client.

- Client produces seemingly false information or identification that appears to be counterfeited, altered or inaccurate.

- Client displays a pattern of name variations from one transaction to another or uses aliases.

- Client alters the transaction after being asked for identity documents.

- The client provides only a non-civic address such as a post office box or disguises a post office box as a civic address for the purpose of concealing their physical address.

- Transactions involve individual(s) identified as being linked to criminal activities.

Money laundering indicators related to client behavior

- Client conducts transactions at different physical locations, or approaches different staff.

- Client exhibits nervous behavior or has a defensive stance to questioning.

- Client presents confusing details about the transaction or knows few details about its purpose.

- Client avoids contact with reporting entity employees or refuses to provide information.

- The client refuses to identify a source for funds or provides information that is false, misleading, or substantially incorrect.

- Client makes inquiries/statements indicating a desire to avoid reporting or tries to persuade the reporting entity not to file/maintain required reports.

- Client closes account after an initial deposit is made without a reasonable explanation.

Money laundering indicators surrounding the financial transactions in relation to the person profile

- The transactional activity is inconsistent with the client’s apparent financial standing, their usual pattern of activities or occupational information.

- Client appears to be living beyond their means.

- Large and/or rapid movement of funds not commensurate with the client’s financial profile.

- Opening accounts when the client’s address or employment address are outside the local service area without a reasonable explanation.

Money laundering indicators related to products and services

- A product and/or service opened on behalf of a person that is inconsistent based on what you know about that client.

- Use of multiple foreign bank accounts for no apparent reason.

- Credit card transactions and payments are exceptionally high for what is expected of the client including an excessive amount of cash advance usage, balance transfer requests or transactions involving luxury items.

Money laundering indicators related to transactions structured below the reporting or identification requirements

- Client appears to be structuring amounts to avoid identification or reporting thresholds.

- Client appears to be collaborating with others to avoid identification or reporting thresholds.

- Multiple transactions conducted below the reporting threshold within a short time period.

- Client makes inquiries that would indicate a desire to avoid reporting or exhibits knowledge of reporting thresholds.

Visit the FINTRAC site to see the full list of indicators.

Guidance from FATF Groups

The Asia/Pacific Group on Money Laundering (APG) also provides information on Vulnerabilities of Casinos and Gaming Sector. Their list of indicators of money laundering using casino accounts includes:

- Frequent deposits of cash, cheques, wire transfers into casino account.

- Funds withdrawn from account shortly after being deposited.

- Account activity with little or no gambling activity.

- Casino account transactions conducted by persons other than account holder.

- Large amounts of cash deposited from unexplained sources.

- Associations with multiple accounts under multiple names.

- Transfer of funds from/to a foreign casino/bank account.

- Transfer of funds into third party accounts.

- Funds transferred from casino account to a charity fund.

- Multiple individuals transferring funds to a single beneficiary.

- Structuring of deposits / withdrawals or wire transfers.

- Using third parties to undertake wire transfers and structuring of deposits.

- Use of an intermediary to make large cash deposits.

- Use of gatekeepers, e.g. accountants and lawyers to undertake transactions.

- Use of multiple names to conduct similar activity.

- Use of casino account as a savings account.

- Activity or income is inconsistent with the customer’s profile.

- Use of false and stolen identities to open and operate casino accounts.

- Customer name and name of account do not match.

- Requests for casino accounts from Politically Exposed Persons (PEPs).

They also provide money laundering indicators using

- winnings

- currency exchange

- credit/debit cards

- false documents and counterfeit currency

- casino value instruments

- structuring/refining methods

For this reason, it is worth referring to the document to learn more about how to mitigate your patron and transaction risks.

Managing money laundering risks continues to be a challenge for the gaming industry. Increasing and changing regulations, along with new gaming products further add to compliance challenges. For this reason, technology like Alessa gives casinos the ability to monitor patrons and their transactions. To learn more about how Alessa can assist with your compliance activities, contact us.